Choosing The Best Cost Segregation Provider

Finding the Best Cost Segregation Advisors for Your Needs

Ultimately, your cost segregation efforts will only be as successful as the quality of your study and analysis permits. Choosing the right cost segregation expert will deliver maximum economic benefits while keeping your risk of legal liability as low as possible.

You will find many cost segregation experts and advisors to choose from, which can make it difficult to determine which one is the best suited for your needs. When choosing the best cost segregation provider for you, consider how important it is to provide the IRS with a detailed, verified analysis should your tax returns come up for audit.

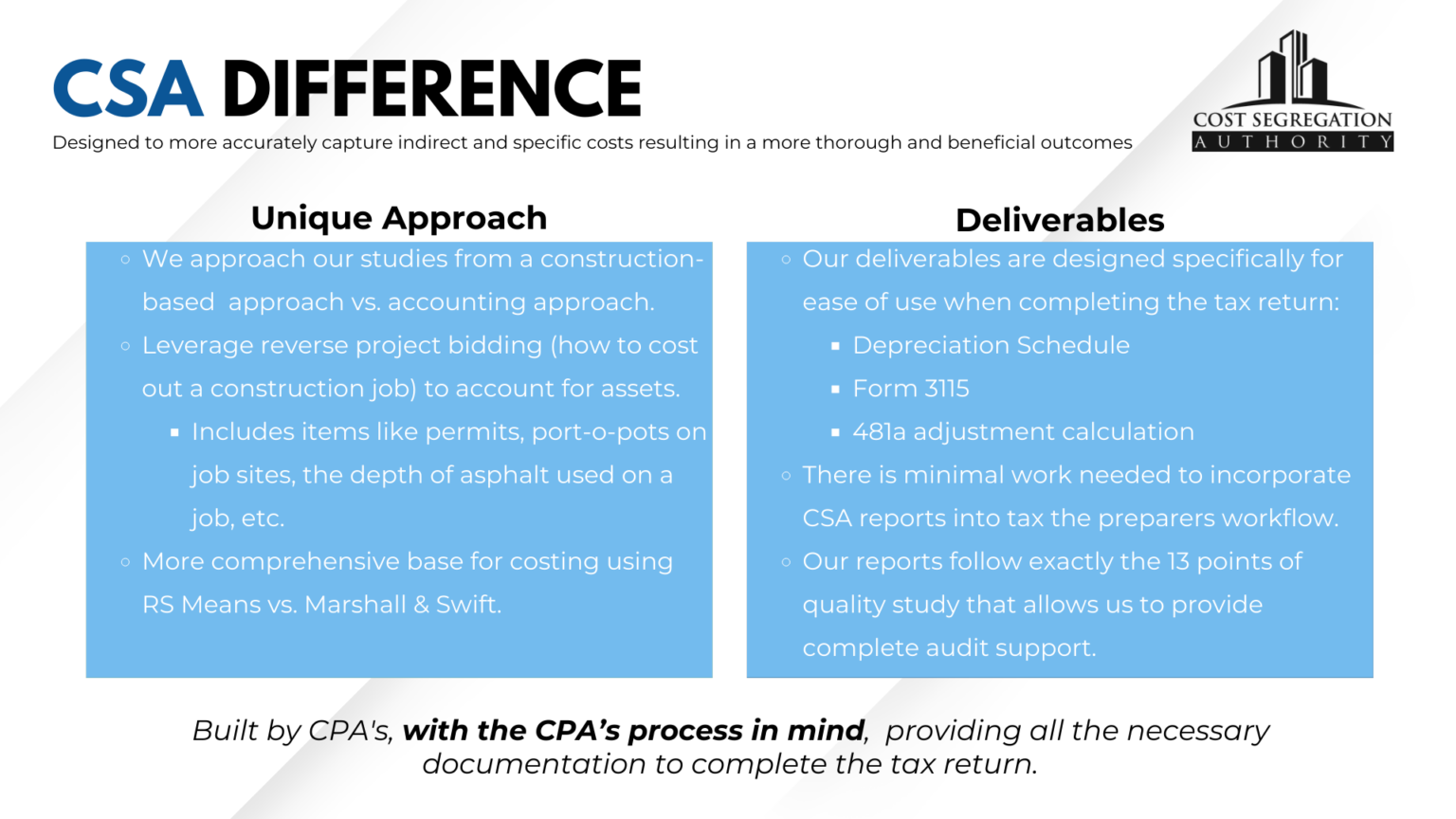

The expert team at Cost Segregation Authority has the background and experience you need. We have performed countless studies for clients ranging from CPA firms, investors, and commercial real estate professionals to builders, developers, franchisees, and corporate enterprise end-users. We provide exceptional service that is tailored specifically to your needs. We also provide no-cost audit support, should the need arise.

Contact us now for a free benefits analysis to see just how much our cost segregation studies and services can benefit you.

Why Cost Segregation Provider Experience Matters

Historically, a large percentage of cost segregation studies and analyses have been conducted by CPA firms. That remains true today, even though few CPAs have the knowledge and background that the IRS requires.

Should your reclassification activities come under scrutiny by the IRS, your study and analysis must comply with the stated requirements for a qualified cost segregation study. In prior legal publications, the IRS has stated that written support for cost segregation and asset reclassification “may not be based on non-contemporaneous records, reconstructed data, or taxpayer’s estimates or assumptions that have no supporting records.” Accounting firms typically adopt a tax-centric approach without delving sufficiently into the technical disciplines of engineering, architecture and construction.

A qualified segregation advisor understands how the study must be conducted and how to document reclassification activities so that the IRS requirements are satisfied. That way, even if you are audited, you can rest assured that your supporting documentation is in order.

What to Look for In a Cost Segregation Advisor

The most important consideration when choosing an advisor to perform your analysis is whether they use a sufficiently technical approach when performing cost segregation studies. This requires in-depth knowledge of various engineering-related professional disciplines – however, it also requires extensive knowledge of the U.S. tax code and applicable case law.

Extensive experience is important, but also consider what types of clients the cost segregation study provider has worked for in the past. Look for a provider that will share case studies or examples of their past work. Although past results might not reflect directly on your outcomes, they do reflect the provider’s commitment to getting the job done right for their clients.

The provider you choose doesn’t necessarily need a long list of high-profile clients – although that can’t hurt – but they should have demonstrated experience working with other clients like you.

Finally, consider choosing a professional services provider that deals exclusively in performing cost segregation services, studies, and analyses. This ensures that the advisor you choose isn’t spreading their efforts too thin to focus on the critical task at hand.

Why Choose Cost Segregation Authority for Your Study & Analysis

Since the early 2000s, the Cost Segregation Authority team has been solely focused on cost segregation studies and analyses. We have performed thousands of studies for clients across the U.S., ranging from small residential rental properties to multi-million-dollar development and renovation projects. As a result, we have helped our clients save millions of dollars.

We pride ourselves on identifying assets for reclassification that others might miss. We are known for our exceptional service and support, including no-cost audit support. We are proud to offer you a no-cost, no-obligation benefit analysis, delivered usually within 24 hours. Contact us today to learn more. We can answer any questions you might have, and explain more about how our cost segregation studies can help you save money and improve cash flow now.